Let’s look at the statistics:

LinkedIn Industry Ranking (2023): Localization ranks 147th out of 535 industries, placing it in the top 28%. There are 603,700 individual profiles and 21,000 Localization accounts on LinkedIn, making up 3% of personal accounts, indicating significant engagement in the Localization industry.

Top Countries for Personal Profiles: United States (US), China (CN), the United Kingdom (UK), Italy (IT), Spain (ES).

This suggests a high demand for localization services into English, Spanish, Italian, and Chinese.

Top Countries for Company Profiles: United Kingdom (UK), United States (US), France (FR), Germany (DE), Brazil (BR).

The difference in top countries for personal vs. company profiles highlights:

1) Global demand for localization services and a diverse talent pool, with remote to hybrid working as a viable model for many.

2) A significant market demand for localization from French, German, and Portuguese into other languages, as evidenced by the presence of companies in France, Germany, and Brazil—countries not listed among the top for personal profiles.

3) The value placed on local expertise within the localization industry.

Considerations on Data Source: The unbalanced presence of LinkedIn might affect the representation of the localization industry. For example, LinkedIn is only beginning to gain traction in China, and some localization companies may not be listed on LinkedIn, potentially skewing the data.

There are 8838 companies in localization in Europe, compared with 3204 in North America, 1624 in Asia, and 1358 in South America, which indicates perhaps: 1) more international companies registered and operating in Europe; 2) a robust demand for localization services in Europe, possibly reflecting the continent’s diverse linguistic landscape and a strong emphasis on localizing content for multiple languages and markets.

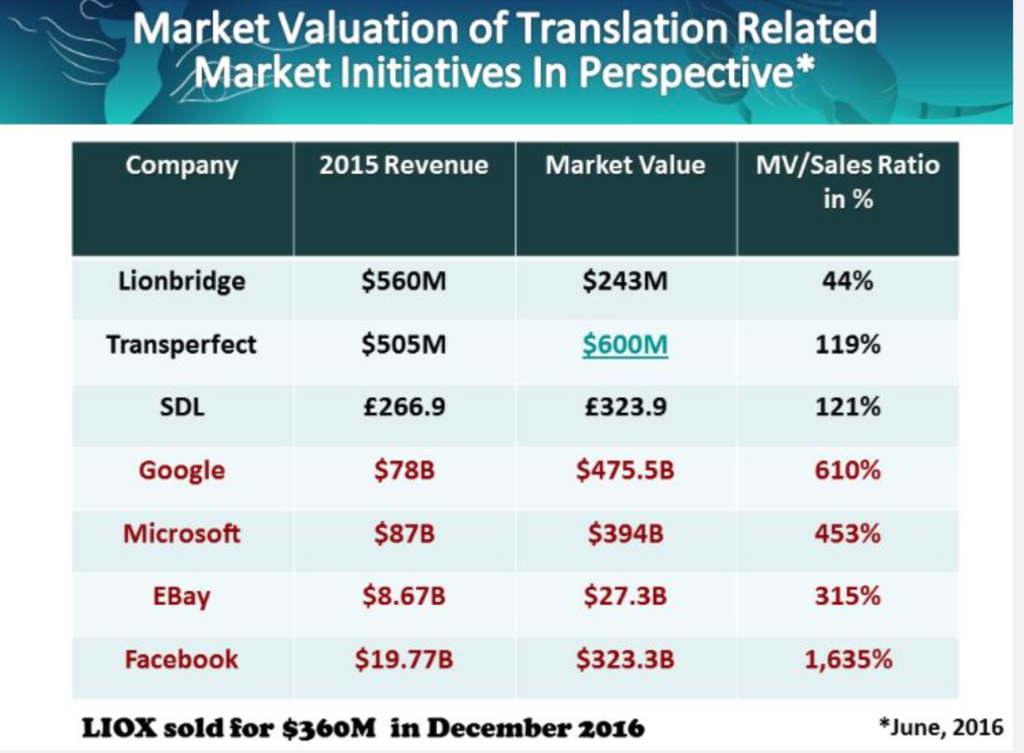

According to this data, it seems that comprehensive companies that do not specialize in localization can gain more by localizing their marketing and function content. So going into the localization departments for big companies might be good.

According to Source: CSA, Nimdzi and Zipdo

Its is estimated that by 2027 value $72.72 billion.

● Asia Pacific regions growth projection is $16.5 Billion by 2028

● Machine Translation projected to reach $1.5 Billion by 2024.

● Voice and speech recognition in tech to $6.9 billion in 2025, affecting language and localization industry.

● Artificial Intelligence highest impact by 45% based on LSPs surveyed.

● In 2019 it was $49. 6 billion and 2021 $56.18 B. This indicated mature growth.

● In 2020 EU market share alone was 49.8% and North America 35.6%. Big companies concentrate in these two regions.

● The top 10% of Localization providers have only 10% market share. This suggests a competitive landscape with numerous players and opportunities for niche and specialized services.

80% of jobs filled by networking

● Apply to 21 – 80 jobs to get 30% chance of getting a job offer.-Job market is difficult.

● Companies receive up to 250 applications.-Intense competition. No time for humans to read resumes. The resumes will be first selected by machines.

● 61.7% get at least 1 interview by sending 1-10 job applications.-Interviews are hard to come by.

● 51% of job seekers receive a job offer after three job interviews.-Jobs are hard to come by.

Before concluding, a series of questions arise: amidst concerns over privacy and intellectual property, how can Language Service Providers (LSPs) fully harness the power of AI? Can they develop their models, and if so, from where will they source the necessary data to train these models effectively? Would creating new training materials for translators be necessary? Could this AI trend potentially lead to a reduction in translator numbers?